Wage calculator mn

Mass Time Entry and Labor Distribution MN PS320S. Calculate an estimation of your own wage increases based on the proposed 2021-2023 contract.

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Minimum-wage rate to be adjusted for inflation as of Jan.

. This free easy to use payroll calculator will calculate your take home pay. Well do the math for youall you need to do is enter. The minimum wage in Minnesota means that a full-time worker can expect to earn the following sums as a minimum before tax.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. 23 rows Living Wage Calculation for Minnesota. Labor Relations MN PS180S.

Employee Maintenance MN PS150S. Living Wage Calculation for Minneapolis-St. Results for July 1 2021 are based on a 25 increase and results for July 1.

Minnesota tax year starts from July 01 the year before to June 30 the current year. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Minnesota. 1 2023 to 1059 an hour for large.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Follow the steps below to. Minnesotas Border Battles Part 1.

Just enter the wages tax withholdings and other information required. Use this Minnesota gross pay calculator to gross up wages based on net pay. Show results for Minnesota as a whole.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Minnesota. For example if an employee receives 500 in take-home pay this calculator. Minnesotas Border Battles Part 2.

Select a link below to display the living wage report for that location. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their. Leave Accounting MN PS350S.

This calculator can determine overtime wages as well as calculate the total. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Minnesota. Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Minnesota Hourly Paycheck Calculator. These assume a 40-hour working week. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Counties and Metropolitan Statistical Areas in Minnesota. Simply enter their federal and state W-4 information. Minnesotas minimum-wage rates will be adjusted for inflation Jan.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Pandemic-era Job Postings Reveal Top Occupations Offering Remote Work. Living Wage Calculation for Rochester MN.

Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the 2022 tax year which means the maximum Social Security tax that each. Supports hourly salary income and multiple pay frequencies.

Minnesota Paycheck Calculator Tax Year 2022

Minnesota Wage Calculator Minimum Wage Org

Minnesota Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

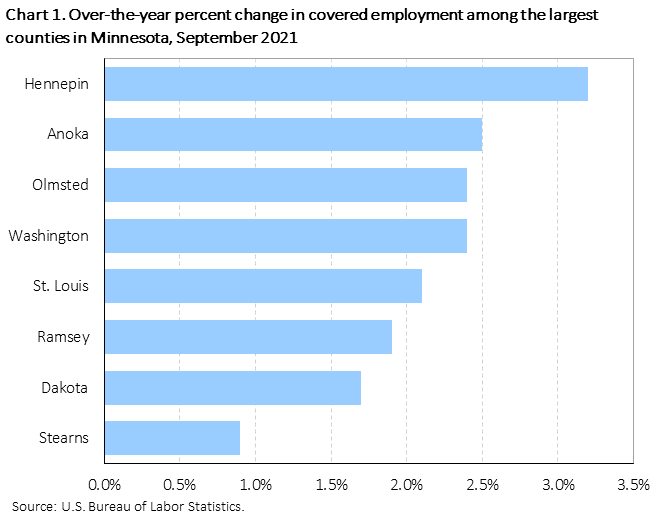

County Employment And Wages In Minnesota Third Quarter 2021 Midwest Information Office U S Bureau Of Labor Statistics

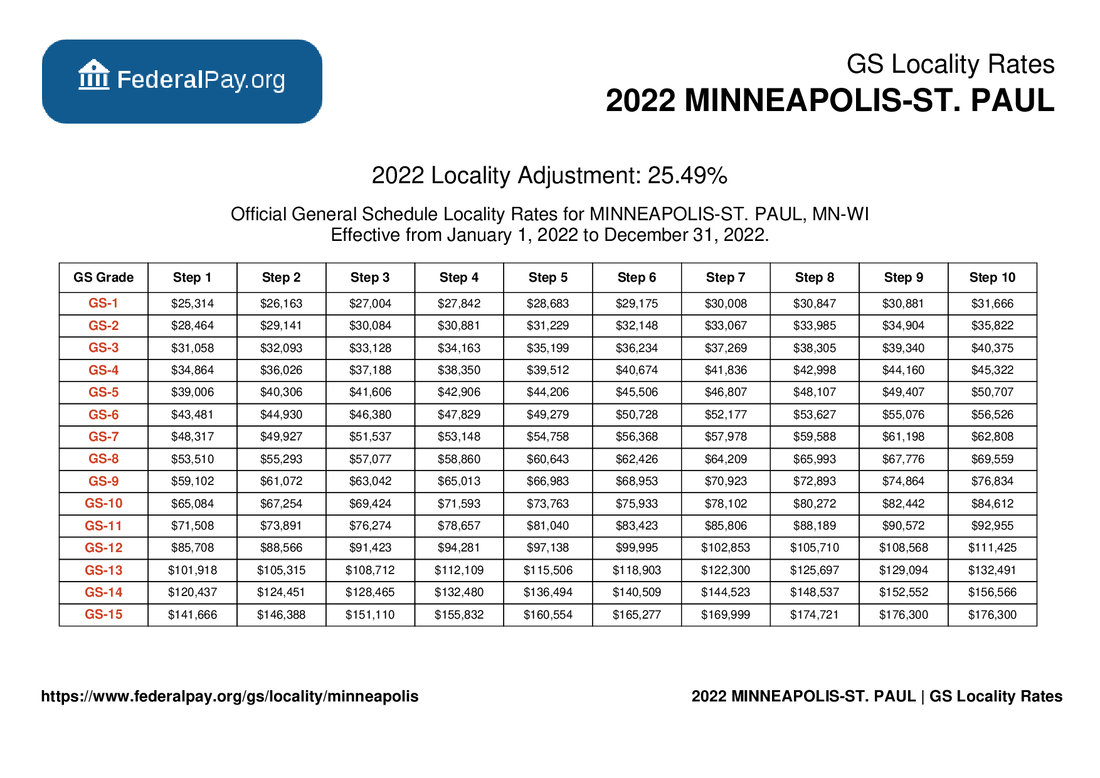

Minneapolis Pay Locality General Schedule Pay Areas

Free Minnesota Payroll Calculator 2022 Mn Tax Rates Onpay

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Minnesota Paycheck Calculator Smartasset

Wage Calculator And Premium Impacts Minnesota Association Of Professional Employees

Free Paycheck Calculator Hourly Salary Usa Dremployee

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hennepin County Mn Property Tax Calculator Smartasset

Paycheck Calculator Template Download Printable Pdf Templateroller

Paycheck Calculator Salaried Employees Primepay

Paycheck Calculator Take Home Pay Calculator